Unlocking Financial Potential: The Power of a Business Credit Builder

Businesses are always looking for ways to grow and expand, but accessing the necessary funds to do so can often be a challenge. This is where a business credit builder comes into play, offering a strategic solution for companies to establish and strengthen their financial foundation.

The Benefits of a Business Credit Builder:

One of the key advantages of utilizing a business credit builder is the ability to separate personal and business finances. By establishing dedicated BUSINESS CREDIT BUILDER accounts and obtaining a BUSINESS CREDIT BUILDER card, companies can build a solid credit profile that stands on its own.

Furthermore, participating in a business credit builder program can pave the way for securing business credit builder loans in the future. This financial support can be instrumental in funding growth initiatives, making investments, or covering unexpected expenses.

Several business credit builder companies specialize in offering business credit builder tradelines and other business credit building services that cater to the unique needs of each organization.

Frequently Asked Questions About Business Credit Builders:

1. What exactly is a business credit builder?

A business credit builder is a service or program designed to help businesses establish, improve, or repair their credit profiles to access better financing options.

2. How long does it take to see results from a business credit builder?

The timeline for seeing results can vary, but many businesses start to notice positive changes within a few months of actively engaging with a BUSINESS CREDIT BUILDER program.

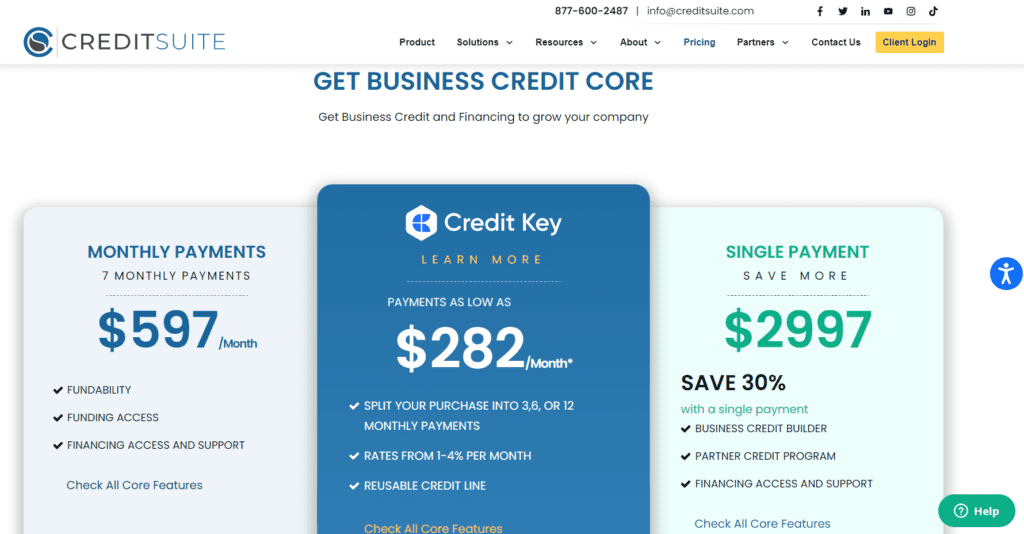

3. Are business credit builders worth the investment?

Yes, especially for companies looking to scale operations or access capital. The benefits of having a robust business credit profile can far outweigh the costs involved.

4. Can any business benefit from a business credit builder?

While the specific advantages may vary, businesses of all sizes and industries can benefit from utilizing a business credit builder to strengthen their financial standing.

5. How do I choose the right BUSINESS CREDIT BUILDER for my company?

It’s essential to research and compare different BUSINESS CREDIT BUILDER companies, read business credit builders reviews, and select a provider that aligns with your business goals and needs.

In Conclusion:

A business credit builder can be a valuable asset in helping businesses navigate the complex world of finances and credit. By taking advantage of the services and resources offered by reputable business credit builder companies, companies can fortify their financial position and unlock new opportunities for growth.